Preparing Your Manufacturing Business for Sale

- On 10/29/2018

Improve your profitability and maximize your valuation

A recent study showed that 75% of business owners regretted selling their business 12 months after closing. This metric addresses the deep regret owners experience when thinking about what they could have done better when selling their business.

There are two factors that typically drive the value of small to medium business:

- Adjusted EBITDA

- Purchase Multiple

“Adjusted EBITDA” (Earning Before Interest Tax Depreciation and Amortization) provides buyers with a normalized view of your business’ earnings and cash flow by excluding the noise associated with financing or capital expenditures. The “Purchase Multiple” was discussed in our previous article entitled “So You Want to Sell Your Business for a Higher Multiple …” where we outline what goes into determining this number.

These two factors multiplied together determine the value of your business. By improving one or both of these variables, your business is mathematically worth more. Most owners don’t proactively address either of these factors and therefore end up regretting the sale of their business.

If you want to be different, there are two initiatives you should focus on at least a year (but preferably more) before soliciting potential acquirers.

Increased Profitability

You can tell if there is material opportunity for improvement by comparing Gross and Net Margins over the past 12 months to your industry averages. Contact us to find out your industry average. For example, five percent profit might be OK for a paper products distributor but it's not OK for a medical device OEM.

There are usually a number of operating changes that can move an under-performing business, say, from 5% to 15% net profit. We have written in this blog extensively about some specific improvements, particularly in the areas of production scheduling, shop floor control, ERP optimization, and inventory management. It’s possible to make operating improvements that yield between 20% to 70% improvement in particular cost categories.

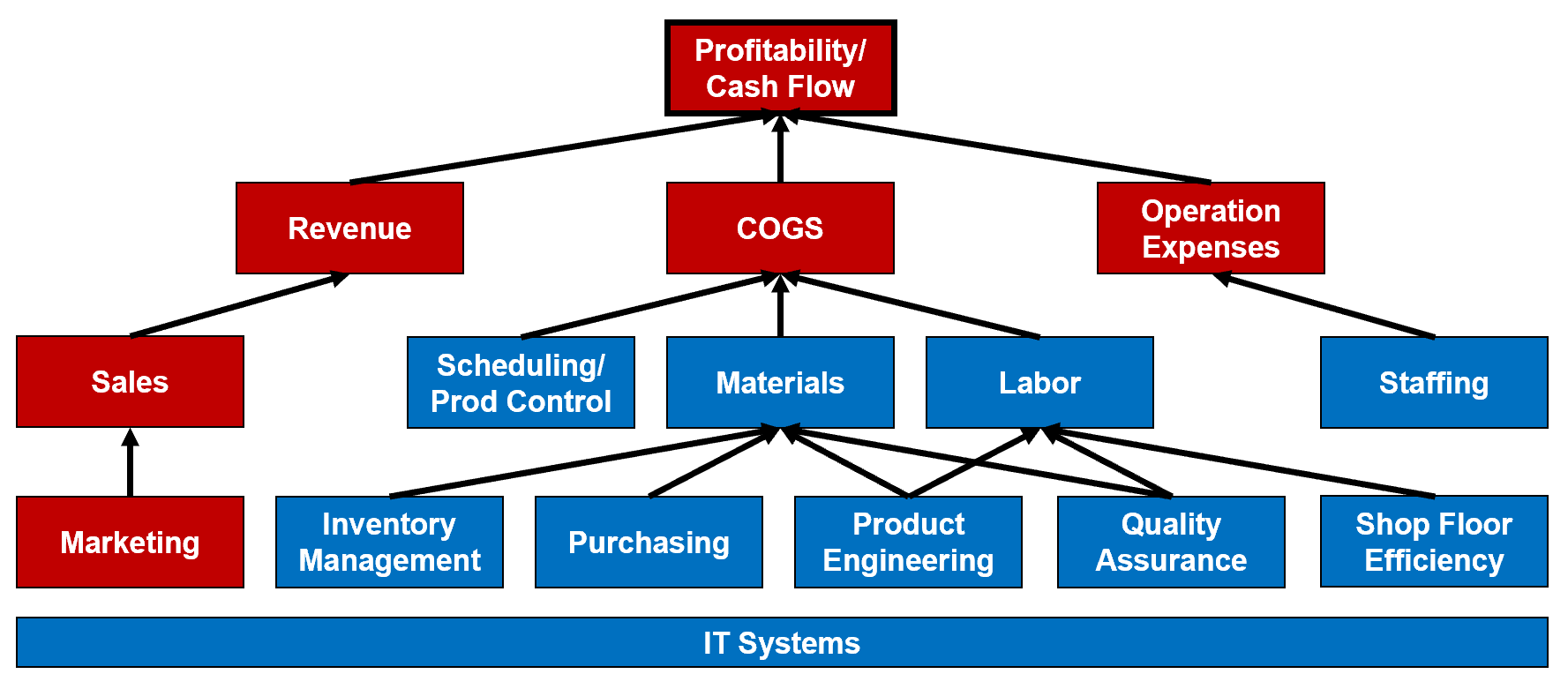

We specialize in making profitability improvements in all of the blue areas shown below that can have a significant impact on your profitability and business valuation.

Aim for an Above Average Multiple

For most buyers, purchase multiples can many times be influenced by: 1) growth prospects, 2) cash flow (net of capital expenditures), 3) certainty, and 4) operating risks. By proactively preparing for a sale, one can create a thoughtful growth story, driving certainty through data (e.g., ERP optimization or improved accounting) and mitigating risks.

Below are a few examples to address:

- Regulatory risk. Are there any regulatory compliance issues that could change either favorably or unfavorably?

- Growth. Are there opportunities for market growth, product improvements, product expansion, new customers, new markets geographies?

- Market risk. Are customers and suppliers in a good state of health? How close to optimum are pricing and costs?

- Operating risk. Is product or service yield problematic? Are quality control trends favorable? Is there a sufficient availability of skilled and qualified labor? Could key personnel easily be replaced if necessary? Are product or service lead times conducive to customer satisfaction? Are fixed costs at levels that can be profitably absorbed?

- Financial risk. Are inventory, accounts payable, and accounts receivable managed in a way that are providing sufficient cash flow from operations?

- Technical risk. How much technical risk is inherent to ongoing product development projects and how is it being managed? Are there technology trends in the market and how well are they understood?

Operating Improvements

If you want to sell your house and want to receive top-dollar offers, you might consider updating the bathrooms and kitchen first. Selling your business is no different. The key is to introduce meaningful operating improvements that will maximize profitability while at the same minimizing operating uncertainty.

Some of these improvements may be tangible nuts-and-bolts operating improvements that directly impact the bottom line. Other improvements may be more indirect in nature but helpful nevertheless in improving the overall efficiency of operating the business and enabling growth. Providing improved management information, for example, is something that can reduce some of the forms of uncertainty we discussed earlier. The goal is to add value not only in the pages of the financial statements (i.e., higher EBITDA) but also in the eyes of potential acquirers by instituting professional management practices, creating operating efficiencies, and implementing bottom-line improvements throughout the enterprise.

Next Steps

The good news is that you can, for a fee that’s contingent on realized improvements in monthly profitability and/or the sales valuation of your business, obtain the specialized expertise needed to help formulate and execute a strategic plan for a successful exit.

Altemir Consulting, working together with your executive management, operations team, and potential acquirers, can assist you in laying the groundwork for significantly improving your profitability, maximizing your business valuation, and providing sales-side management support.

Feel free to schedule a free no obligation 15-minute phone call to discuss your particular situation and chart a course forward.