Demand Forecasting: How Not to Do It

- On 12/30/2019

Many manufacturers and distributors encounter common pitfalls when formulating their demand forecasts and operational planning

The old adage is that forecasts are always wrong. Since no one can see into the future, this is certainly true. However, we can observe how our forecasts are wrong over time and optimize them accordingly in a way that minimizes operating costs while maximizing on-time performance to the customer. We can take steps to ensure that we appropriately implement our forecasts to best drive purchasing and/or manufacturing. There are also practical approaches we can take to reduce the effort needed to generate new forecasts. In fact, in some cases, the forecasting processes can be partially automated, even for thousands of SKUs.

The details of how forecasts are generated and the way that they are put to use can have dramatic implications for distributors who must economically plan their warehouse inventory as well as make-to-stock manufacturers who rely on sales forecasts to drive production.

Since our focus is on outlining some of the pitfalls, we first need to understand two key terms concerning demand forecasting: "accuracy" and "precision".

The Effect of Bias on Forecast Accuracy

"Forecast accuracy" can be a loaded term and it can mean different things to different people. In the context of demand planning, what's ultimately important is that the average error between forecast and actual demand be minimized over a specified time period, usually 12 months. Theoretically, that means that relatively large forecast errors can be allowed to exist just so long as they offset each other over the long run. From a practical standpoint, we want to eliminate any inherent bias that has inadvertently crept into our forecasts and is contributing to increasing the average overall error.

Noise in a forecast can often be tolerated, but a recurring and persistent bias in forecasted demand can have negative financial and cash flow implications. This is because demand forecasts that are consistently wrong over the long run will end up costing you money (e.g., unnecessary procurement, high inventory, overtime labor) if they are used to drive inventory, production, or capital investments. Fortunately, an analysis of past forecasts and their performance can shed light on whether any biases have been inadvertently injected into the demand planning process.

Forecast Over-Precision and Micro-Management

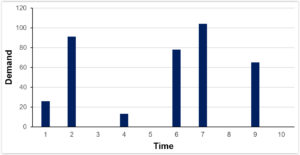

The question of "forecast precision" comes into play with how future demand is placed on the timeline when formulating the forecast. The forecast below illustrates a situation where, for most businesses, forecast demand has very likely been micro-managed in a non-value-added way.

If this were a sales forecast, it's highly unlikely that the sales team would know with any degree of fidelity that large orders will materialize in periods 2, 6, and 7 and that periods 3, 5, 8, and 10 will remain completely barren. This forecasting example represents an extreme form of "market timing" that, if followed explicitly by the company, could lead to alternating periods of overstock and shortage when we find out that actual demand doesn't exactly match the forecast. Even if the forecast is "accurate" over the long term with offsetting errors, we could still experience cash flow impacts due to out-of-phase supply and demand resulting from an overly "precise" demand forecast.

Some distributors or manufacturers may have seasonal products where some level of precision is warranted. What's important in this case is that the effects of seasonality be appropriately evaluated and applied using a statistical approach that reduces noise and avoids introducing non-value-added demand volatility into the forecast.

Those of you familiar with our supply chain consulting practice and Lean MRP production control paradigm know that demand volatility improperly managed is often the root cause of high inventory, long lead times, and poor on-time performance. It's therefore important to minimize volatility introduced via ill-defined demand forecasts.

The effects of demand volatility are illustrated in the following three-minute video:

Demand volatility can be especially problematic when customers require their suppliers to adhere to constantly changing demand forecasts as the video illustrates. The situation is further exacerbated when the customer commands a large portion of a supplier's business. Over-managed and over-exercised demand forecasts test suppliers' capacity by introducing demand spikes and make on-time shipments challenging not only for the principal customer but also for suppliers' other customers who must compete for supplier capacity in an environment where work priorities are constantly changing.

Fortunately, there are ways of resolving the effects of overly-precise forecast volatility, both for those forecasts generated internally as well as those imposed externally by customers.

Improperly Implemented Demand Forecasts

Once you have a demand planning forecast, what do you do with it? If you want it to drive your inventory planning, then you can either 1) load it into your ERP system to drive manufacturing and/or purchase orders directly or 2) you can use it to drive planned inventory levels. Let's focus on the latter since it is an area that often goes wrong.

The question is how do you use your ERP to establish target inventory levels for each item? There are a variety of methods that systems commonly use and so there are different ways to do it. If the forecast is used in a way that is either redundant with or not compatible with one of these inventory planning methods, then inventory target levels will likely be overstated, thus driving up inventory unnecessarily. The technical details of how to resolve this are beyond the scope of this article, but suffice it to say that these issues are almost always tractable, particularly when the forecasts are generated internally.

Sales, Inventory, and Operations Planning (SIOP)

For readers that are not familiar with SIOP, it is an integrated planning management paradigm that seeks to align inventory, production, staffing, and capital planning with sales demand. It is essentially a formal corporate process used to "throttle" the company's operations and investments so that they can work together to effectively meet customer demand. Since procurement, manufacturing, staffing, or capital planning lead times may in some cases be long, demand forecasting plays an essential role that allows managers to "see over the horizon". Companies that feel the need to tighten their strategic planning processes should consider the implementation of a formal SIOP process as an effective way of navigating market upturns and downturns.